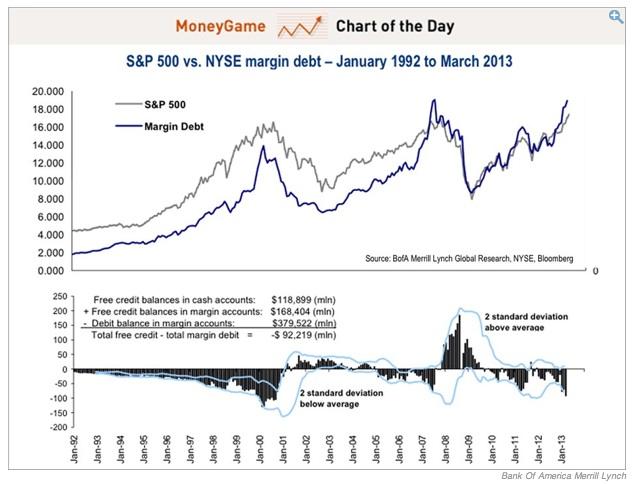

A couple of weeks ago, Business Insider made the point quite clearly in their chart of the day: investors are now leveraging their stock market bets like its 2007.

In other words, they are betting with money they don't have, and it is this debt bubble which is driving the stock market.

Surely the rising stock market is representative of a growing real economy? We know, after all, that stock market prices represent the value of companies, don't they? Well, lets look at the economic effect of this. Perhaps the rising stock market is having a beneficial effect on the real economy?

Not in Britain, it seems. Nor in Europe. Nor the United States.

Oh dear.

This stark reality demonstrates quite clearly that the financial system does not care about the real economic implications for billions of souls on this planet of its activities. They are playing a great game, and no-one else counts.

Indeed David Camreon and George Osborne, by putting the markets first in every dicision they make, clearly feel exactly the same.

Last week, as covered by Zerohedge, PIMCO's Bill Gross warned that he sees bubbles everywhere.

We see bubbles everywhere, and that is not to be dramatic and not to suggest they will pop immediately. I just suggested in the bond market with a bubble in treasuries and bubble in narrow credit spreads and high-yield prices, that perhaps there is a significant distortion there. Having said that, it suggests that as long as the FED and Bank of Japan and other Central Banks keep writing checks and do not withdraw, then the bubble can be supported as in blowing bubbles. They are blowing bubbles. When that stops there will be repercussions. It doesn't mean something like 2008 but the potential end of the bull markets everywhere. Not just in the bond market but in the stock market as well and a developing one in the house market as well.

And on this morning's Today programme, Stephen King, HSBCs Chief Economist, warned that we "have never had it so good and will never have it as good again."

During the interview he pointed out that financial activity on the stock and bond markets are no more than claims on future economic activity.

In other words, he was clearly admitting that he and his colleages are speculating with the lives of our children, which probably explains the sniggers of the BBC presenters just prior to the interview.

We're probably not looking at some sudden 1923 hyperinflationary shock any more, although the potential for another of these shocks is absolutely built into the system. More likely it will take 50 years to get to the point of needing a wheelbarrow to carry the cash we need for our weekly shop.

But the message being delivered is quite clear - we, our children and grandchildren are staring a long slow painful decline into third world standards of living in the face.

So Jon Snow is right to be concerned. The alarm bells are ringing clearly for me. No lessons have been learned. The elites continue their game. Their intention is to demolish the so-called developed world, but at a pace which keeps the natives docile.

This might seem like just more doom laden rhetoric from me, but frankly my frustration is that the situation is so easy to fix.

All it takes is for people to recognise the reality of what we face, demand the split up of the banks and the return of the Bradbury Pound, and before we know it we would have a bright future.